Introduction¶

In normal use, payslips from a given payroll will include the employer name and employer address at the top of the page. However, there may be times when it is preferable to show a different name and/or address at the head of a payslip. For example, when the employer runs the payroll for more than one franchise or sub-company they may want to keep the payroll processing under a single organisational payroll but show employees as working for different franchise / sub-group / employer on their payslips. As far as HMRC is concerned, though, the payroll scheme is the same and all EPS and FPS filing goes to the same place.

To enable this we have an alternate employer name facility built in to Apollo Payroll that enables a different name and/or address to appear on payslips either for an entire payroll or for individual employees within the payroll - based on the payroll analysis code.

Setup¶

Alternate employer for a payroll¶

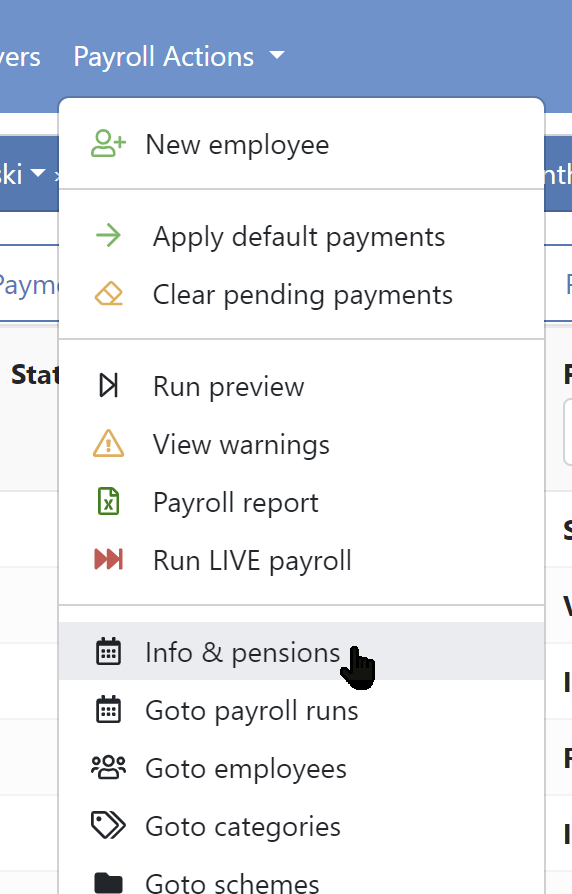

We can set the entire payroll to use a different name or address on payslips by specifying the name and address details in the Info & pensions screen for the payroll.

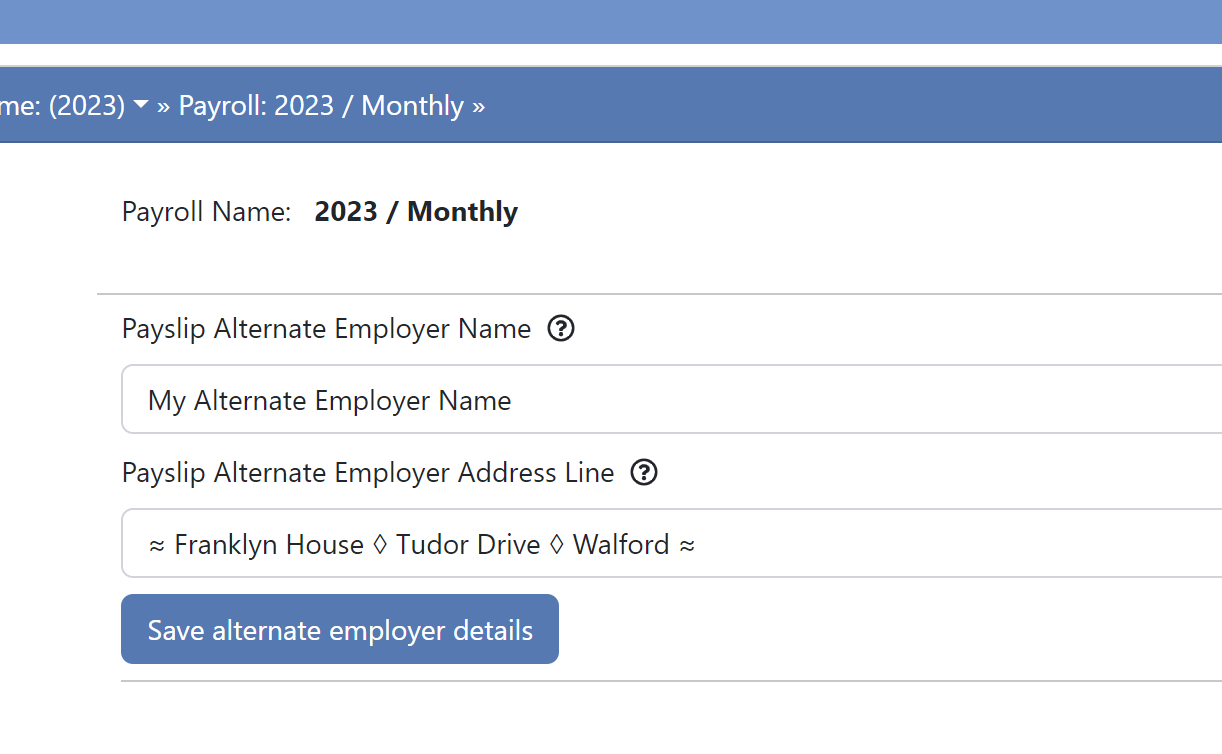

In the screen that follows we can enter details for the name and/or address to be used on all payslips for the payroll (unless overridden by analysis codes. See below.)

Once we have entered the details press the Save alternate employer details button to save the changes. All subsequent payroll runs will use this information for payslip headers. Previous payroll runs will continue to use the heading in place when the payroll run was created and if the details are changed in the future the changes will only affect payroll runs created after the changes.

Extended characters, such as • ◊ ≈, that appear in the Verdana font set may be used in the name and address text, as shown (emojis are not supported!). If the font doesn't support the characters entered they will appear as blank space in the final payslip.

Alternate employer by analysis code¶

An alternative (or, in addition) to applying the alternate name to the whole payroll is to apply it via the payroll analysis codes.

For each payroll you can set up any number of analysis codes in two groups of codes. Each employee can, optionally, be assigned to one code from each group. The analysis codes in group 1 can also have an alternate employer name and/or address attached to them. Thus, any employee who is assigned to a given code from group 1 will also have the supplied alternate employer name and address (if any) from that code on their payslip.

NB: This setting will override the settings for the overall payroll, if any.

-

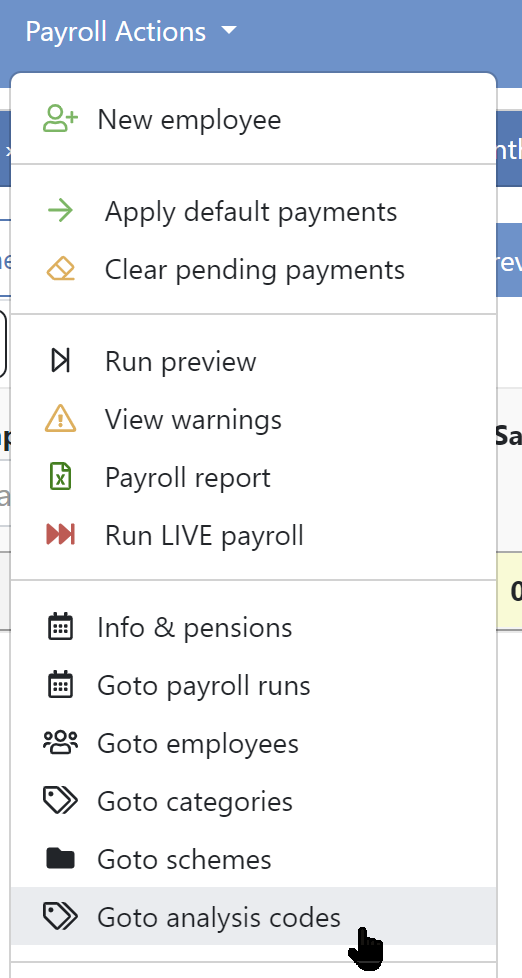

Go to the payroll analysis codes screen

-

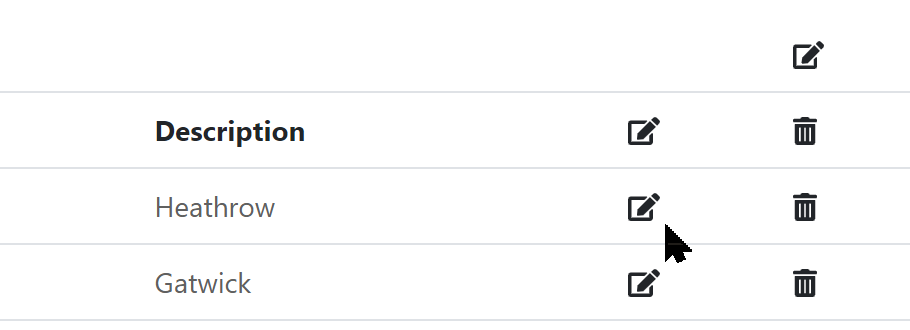

Click on the button to edit a code in the left hand side (group 1) set of codes, or click the

+ Addbutton to add a new code.

-

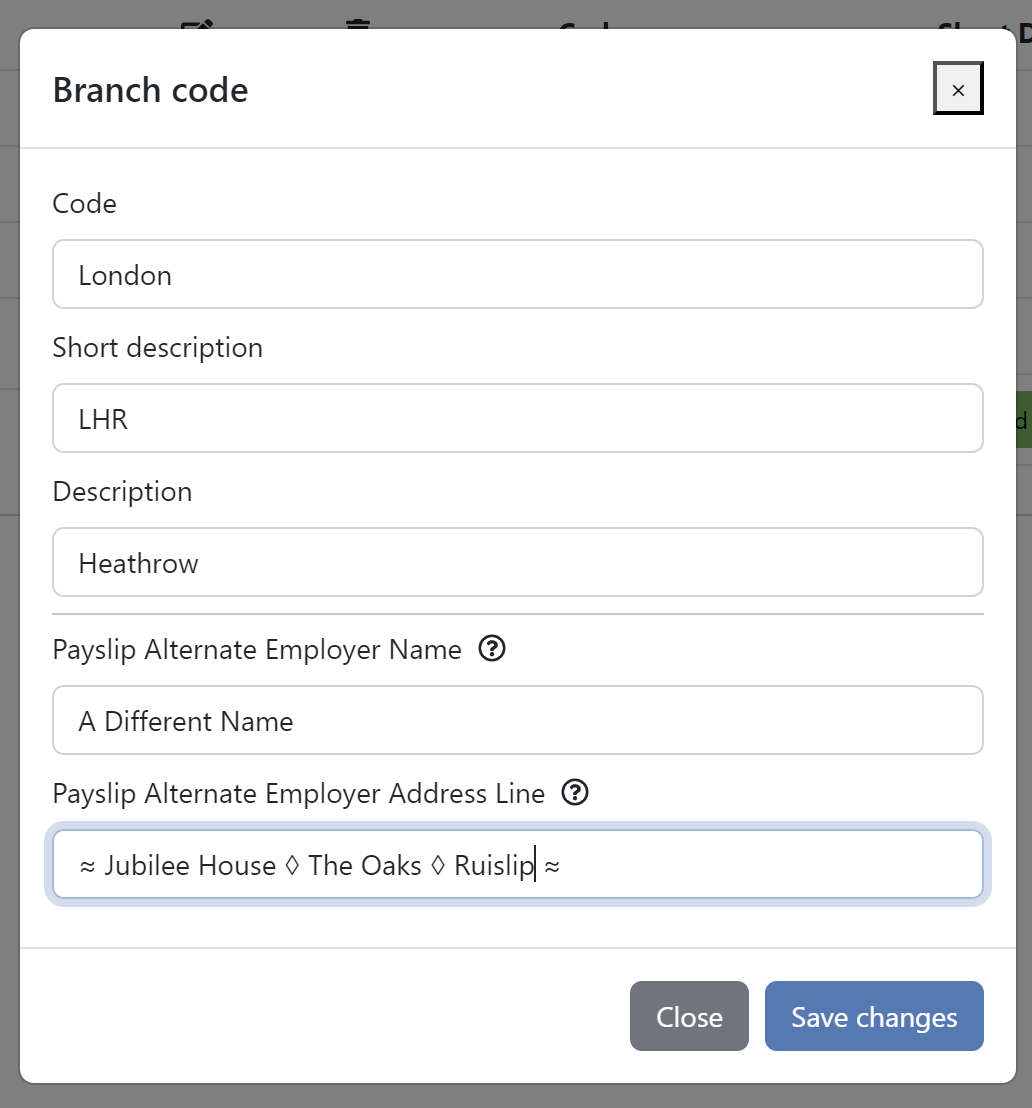

In the following dialog enter the alternate employer name details as required and press the

Save changeswhen finished.

As above, extended characters, such as • ◊ ≈, that appear in the Verdana font set may be used in the name and address text, as shown (emojis are not supported). If the font doesn't support the characters entered they will appear as blank space in the final payslip.

-

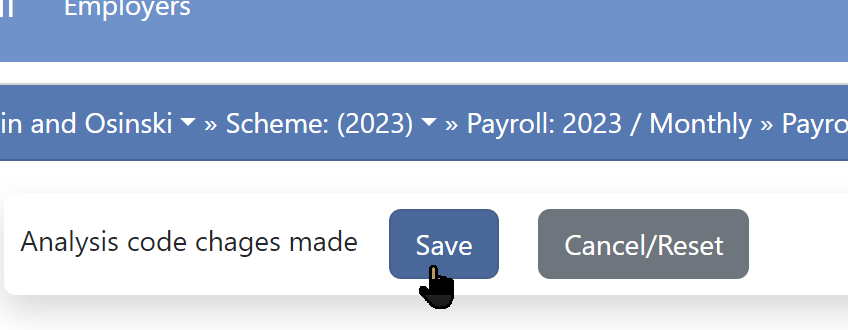

When finished making all analysis code changes make sure to press the

Savebutton to save all changes.

Note, also, that only the group 1 codes can have the alternate details. That is, only the codes on the left hand side of the edit screen.